“I’ve found that banks,” said Tom Selleck, “are mostly run by very prosperous, happy people.”

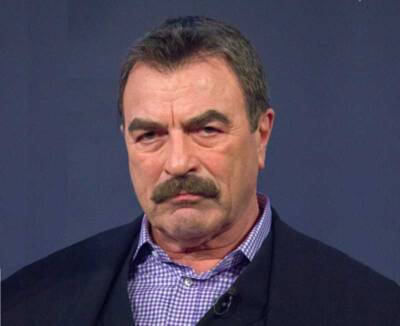

Long-time television personality Tom Selleck (Magnum, P.I, Blue Bloods) has come under fire for misleading seniors to put their homes at risk by signing up for reverse mortgage loans from American Advisors Group “with a muddle of misleading terms, conditions and stipulations.” It is, say critics, a way of dispossessing needy seniors from their homes.

Corporations often enlist celebrity spokespersons whose identity is compatible with the company’s target demographics. And reverse mortgage loans, whereby a homeowner with equity in his residence can receive tax-free monthly stipends as part of a loan program, are principally utilized by American seniors 62 and over. Selleck has been spokesperson for AAG since 2016.

One frequent criticism cited is that Selleck, 77, has a reputed net wealth of $45 million, meaning he will never use the service himself. When contacted at his home in Palm Springs, Selleck begged to differ. “Nothing is safe these days,” he said. “The stock market could crash, the price of beach-front property and gold bars could bottom out; you just never know.”

One of the principal criticisms of reverse mortgage loans is high fees, including mortgage insurance fees and finance fees, which can run more than twice that of a refinance. Monthly fees can increase, making some borrows susceptible to foreclosure. Mildred Tory, 80, when interviewed for this article, said she didn’t really know what she was signing when she enlisted in the program. “The most important thing,” she declared, was that “Thomas was recommending the plan.” When asked if she regretted her decision to take a reverse mortgage, she shook her head firmly from her bed in the homeless shelter and said, “No. I trust Thomas. After all,” she added with a smile, “He’s Magnum, you know.”

In response to mounting criticism of AAG and Selleck’s role in the company, the marketing department recently revamped their commercials featuring the Blue Bloods star. When interviewed at his summer home in Oslo, Selleck responded to a complaint that if the home owner dies before the loan is repaid, the estate goes not to their heirs, but to the bank: “I am thoroughly tired of the children of hard-working Americans sponging off their parents, even past their lifetimes. Let these bloodsuckers make their own way,” he snarled.

Another complaint is the fact that the loanee must continue to live in the home, whether or not they want to or are able to. This restriction applies even in those instances in which an elderly borrower requires nursing home care. “That’s not a problem, really,” asserted Selleck. “Once their home is seized and their bank accounts are empty, they can qualify for Medicaid and then slip into the extended care facility; easy as pie.” Additionally, if the spouse of the borrower is not at least 62 at the time of the signing, he or she will not be able to inherit the loan repayments; again, the estate goes to the bank. When asked to comment, Selleck was cryptic. “I’ve found that banks,” said Selleck, “are mostly run by very prosperous, happy people.” He flashed his folksy Magnum, P.I. smile.

When this reporter noted that the homeowner is required to maintain insurance premiums, property taxes, and to keep up the property, Selleck appeared injured. “Well, they get to live there, don’t they?” he said. “It’s not like the bank manager — who may get the home in the long run — can just move in anytime he wants. Come on.”

On screen, Selleck assures the viewers that a reverse mortgage “is not a way for the bank to get your house.” A close-up shows the personality’s twinkling eyes. Tom Selleck, remarked Virginia Brower, AAG spokesperson for marketing, “is a better actor than most people even suspect.” According to a New York Times article, AAG advertised their loans “as essentially risk free.” Said Selleck: “What do you want, the world?”

Questioned about AAG’s $400,000 penalty for misleading seniors, Selleck, reached at his winter home in Hawaii, said, “Into every day a little rain must fall.” Back on screen, in the new ad, Selleck gravely intones, “This is not my first rodeo.” He goes on to say that “AAG has helped more than a million Americans…” Marketing spokesperson Brower insisted that the incidence of foreclosures over AAG loans — numbering more than 960,000 — “was merely a coincidence.”

- Trump Declares Himself King, ‘In Perpetuity’ - July 10, 2025

- ICE Raids Humor Times Offices Over July 4 Weekend - July 7, 2025

- Trump to Star in ‘Spamalot’ Revival - July 5, 2025